According to the Federal Trade Commission, fraudulent acts cost consumers almost $3.3 billion in total losses in 2020. People who are most in need or most inclined to accept a false offer are targeted by potential fraudsters. If you don’t take precautions, you can wind up the victim of a personal loan scam where you stand to lose money.

So, in this blog post, I will be sharing a complete detail of Spirit lenders , spirit lenders scam or legit, Spirit bank lending scheme. We will make in depth research about the validity of spirit bank lending schemes and will let to know our readers if there is any scam associated with it, because we are getting lots of queries about the scam of the website.

Table of contents:

What is Spirit bank or Spirit Lenders?

Banking Structure of Spirit bank and what are Spirit Lenders?

Spirit Bank Portfolio Reviews:

# Spirit Lenders Reviews –Is Spirit Lending is a Legit or scam?

What is Spirit bank?

Company’s history is linked with the formation of the wonderful state of Oklahoma. Eight local merchants organized an association to establish a bank in Bristow, Oklahoma, only a few years after Oklahoma officially became a state. American National Bank opened its doors on May 16, 1916.

The “family” environment that many of our clients experience when they enter our doors started in the 1930s, when Albert Kelly took over as American National Bank’s non-managing chairman of the board. Though there has been enormous growth, a name change and several milestones along the road, the Kelly family is still a vital part of SpiritBank three generations later.

Banking Structure of Spirit bank and what are Spirit Lenders?

Spirit lenders are used for spirit bank interchangeably. The bank deals in many online services of Mobile banking Internet banking and many more. There are many services options available for customers and businessmen.

Business services: Business loans, SBA Lending, USDA rural development, Cash Advantage, Business credit services, insurance, Money market transactions, PPP Loan forgiveness.

Personal Loans: Checking, Savings, Money Market, Certificate of savings, Personal loans, Credit carsd, IRAS, Advanced planning etc.

| Note 1: The above mentioned services and upcoming facilities in the blog post will be for informational purpose. We are not solely responsible for any scam or purchase after reading this post. The inserted links and external links to the website are only for representation purpose not for promotional purpose. We are not associated with any third party application or website. |

Spirit Bank Portfolio Review

Member FDIC- Equal Housing Lender.

Website: http://www.spiritbank.com

Industries: Banking

Company size: 51-200 employees

Headquarters: Tulsa, OK

Type: Privately Held

Founded: 1916

Specialties: Mortgages, Checking Accounts, Savings Accounts, Wealth Management, Insurance, Employee Benefits, Cash Management Products, Business Banking, Personal Banking, Business Loans, Consumer Loans, Cash Advantage, SBA Loans, USDA Loans, and Business Lending

Social MEDIA:

Facebook: https://www.facebook.com/MySpiritBank

Linkedin: https://www.linkedin.com/company/spiritbank/

Instagram: https://www.instagram.com/myspiritbank

Spirit Bank- Personal Loans Personal Banking:

The bank has many features in personal loan banking. Whether you are required to buy a house, a new car, or fund for your child education, the spirit bank personal banking will let you to meet your requirements.

- Quick decisions

- Flexible terms

- Automatic payment deductions from a SpiritBank checking account available

- Pre-approved loans

- Motorcycles

- Boats

- Recreational vehicles

- CD secured loans

- Unsecured loans

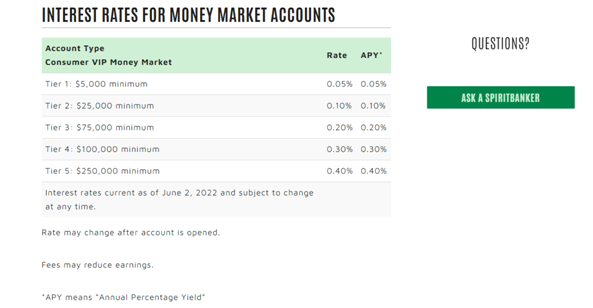

Apart from Personal loans, it provides various other facilities like Checking, savings, Consumer VIP Money market, Certificate of deposits, credit cards etc. Let’s have a look at the present “Interest rates for Money Market Accounts”.

Business Loans- Business Resource Centre: Commercial Loan Review

SpiritBank can assist you if you require money to grow your company, buy a new facility, acquire a rival, or free up your receivables as your firm develops.

- Working capital

- The purchase of machinery and equipment

- Construction or improvement of real property

- Financing –Business startups, Machinery, Equipment, Inventory, Working Capital

- Refinancing-Growth, Diversification, Restructuring

- Expansion-Expanded inventory, additional equipment.

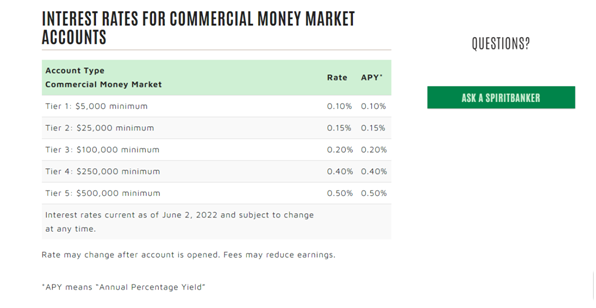

Besides Commercial business loans, the spirit lenders provides many online facilities to its client e.g. Cash advantage, USDA rural development loans, Business credit cards, money market transactions, and many more. Let’s take a look at the present money market interest rates.

If you have still doubts about the SBA Lending of the bank, visit the official page of Spirit Bank.

https://lnkd.in/gXhEWtm?trk=organization-update_share-update_update-text

# Spirit Lenders Reviews –Is Spirit Lending is a scam?

In our research and finding, we didn’t find any customer review for the spirit lender. There are not any positive and negative feedback from customers. Here is a screenshot from their linkedin page in which the SBA Lender is claimed to provide loan to business owners.

The reviews are positive. But the main point is that we can’t find independent reviews which is a great source to know the legitimacy of the website.

This is a screenshot from reddit. The above comment is not sufficient to make any decision.

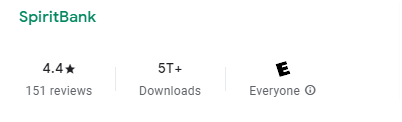

You can download Spirit bank official mobile app from the link below:

Spirit Bank Mobile Banking for Adroid

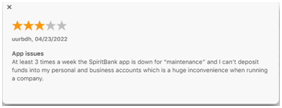

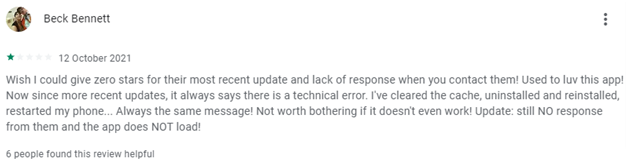

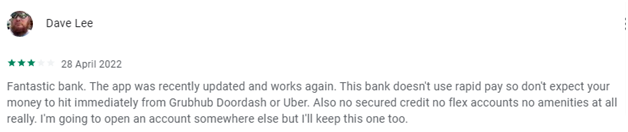

The above reviews are from the Google play store and App store. We can’t make any judgment about the legitimacy of website. The customer reactions are mixed.

You can visit the following link to know more about the the legitimacy of any Lending website.

Spirit lenders Scam- Is it True?

You have probably heard about those emails that claim to be from the big boss and which often start off with a line similar to this, “I need you to do something for me.” Frequently there is also a sense of urgency inferred that makes the average worker bee jump to attention when such an email hits their inbox. Unfortunately, criminals have figured out that impersonating a person in authority at an organization, or even a known vendor to whom you may remit payments, often results in action being taken that benefits the criminal. Let’s look at a few different ways this fraudulent scenario may play out, as well as a few tips on how to protect your organization from falling victim to these crimes. You can further check:

Conclusion:

At last, we suggest our readers to do a proper research before making any final decision for taking any loan. We present a complete view of the bank to you, its reviews and bank details. You may contact to Spirit Bank or any other official authority to know the complete procedure of the loan process or any other general queries.